Analyzing total cost of ownership

You’ve probably read about how moving to the cloud can lower total cost of ownership (TCO) by reducing the upfront investment and ongoing maintenance costs associated with traditional IT services. Too often, though, decision makers analyze IT costs independent of other organizational functions (marketing, sales, etc.). As a result, they fail to account for the cost savings of related upstream or downstream services. Like the old joke says, when you base decisions off bad data, you make bad decisions with certainty.

Scenario

Let’s consider a common scenario where an IT organization is trying to determine if it is more cost-effective to replace an on-premise e-mail service with a cloud service. The CIO can’t reach a conclusion by simply adding up licensing costs and comparing that with the subscription cost. He must stop and ask how much time his engineers spend with the following:

- Software and hardware development, testing, setup, installation, deployment, and support

- Complex customization and end-to-end system integration

- Business requirements and process definition

- End user training for internal and external customers and partners

These costs are also expected when standing up a cloud e-mail service, but they are probably not equivalent because the effort is shared between the customer and the Cloud Service Provider (CSP). The total cost of ownership calculator from Software Advice can help you analyze TCO for on-premises software systems and compare them with cloud offerings. The calculator offers a solid start, but isn’t comprehensive. It fails to account for upstream and downstream impacts to related services.

To find efficiencies within IT spend, you must first have access to the right information. Often times, CIOs fund projects based on the outcome of annual planning drills that follow a strategic roadmap. But creating business value and competitive advantage requires more than a strategic roadmap. This leads us to the value chain.

The value chain

In the mid-80’s, Michael Porter introduced the value chain as a tool for creating competitive advantage. He identified a generic set of interrelated activities common to a wide range of firms. Primary activities included Inbound Logistics, Operations, Outbound Logistics, Marketing, Sales, and Service. Secondary activities included Procurement, Human Resources, Technological Development, and Infrastructure. The value chain can help analyze the delivery of any mix of products and services to an end customer. By mapping and analyzing the upstream and downstream impacts of a specific activity or service along the value chain, there is opportunity to identity and exploit efficiencies.

Scenario continued

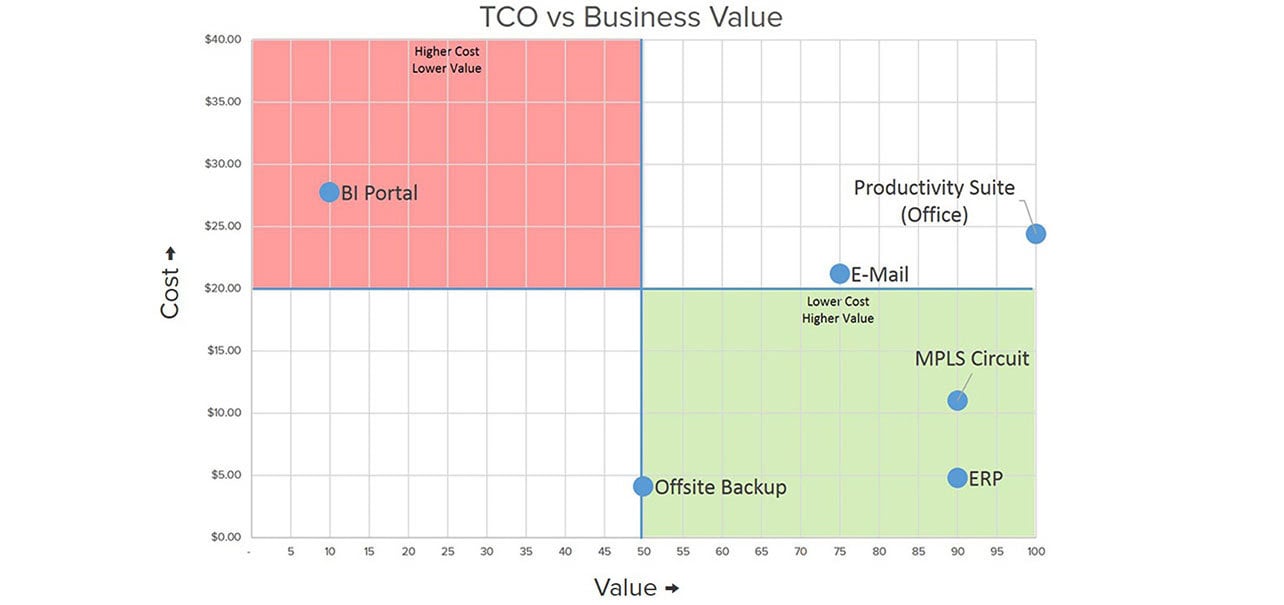

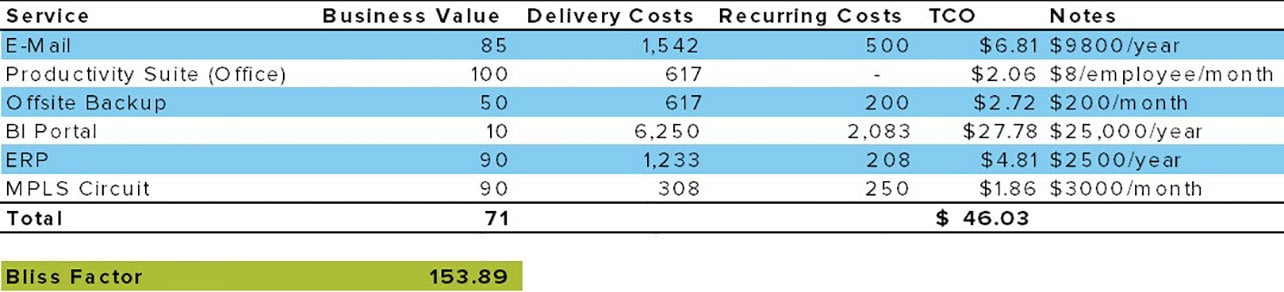

Let’s return to our scenario. Our CIO decides to perform an analysis of six major IT services for his 300-employee branch office. He assigns a relative business value and a TCO number to each service.

Assumptions:

Email servers are installed and managed at a co-location hoster’s facility and connected to the branch office by an MPLS circuit. Office is the preferred productivity suite and is volume licensed at eight dollars per employee per month. Off-site backup is primarily for the email data and is charged as a separate service. A custom customer support system application is being maintained in-house and housed in a data center in the branch office.

The business value figures are relative to each other, with the highest rated service (Productivity Suite) receiving a value of 100—the business would simply not survive without it. Please note that there are several ways to accurately derive business value, but that’s a subject for another blog post.

Bliss Factor:

The Bliss Factor is a simple “goodness measure” of what performs best based on your value criteria. It is what gives you, the CIO, the most bliss and peace of mind. The actual bliss function (in this case a cost to value ratio) is not important. What is important is that you consistently apply a formula that accurately reflects the organization’s perceived business value of the services you provide.

Once the TCO and business values are established, they can be plotted:

Change Impact Analysis

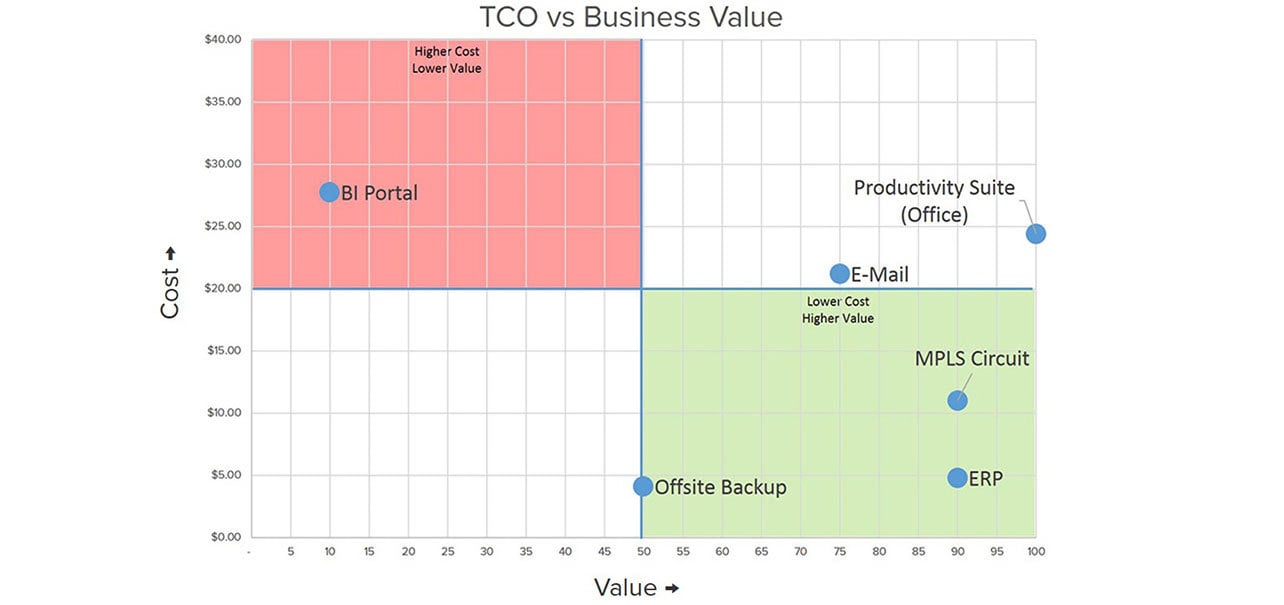

In this case, our CIO is examining whether or not he should move his email infrastructure to Office 365. So, he re-analyzes the cost of delivering all services if he were to replace the volume license for Office with Office 365. A key element of this analysis is to determine if anything else he pays for changes.

The first costs to go are the recurring license fees for Exchange, the equipment, and support staff. Next are the license fees for Office and the majority of those related delivery costs.

Since Microsoft automatically backs up email data, and charges for that service are built into the subscription, the business won’t need as much backup storage. Then again, since office 365 is hosted on Azure, perhaps the al-la-carte off-site backup service can be eliminated entirely and replaced with an Azure backup service. One benefit of cloud transformation is the value received from employing best-of-class services from focused best-of-breed experts. Another benefit is the ability to transfer operational risk and related costs to the vendor.

The MPLS circuit can be eliminated because the business no longer requires the security or bandwidth of a metro circuit to the co-location vendor. IT can beef up the more cost-effective business internet connection to handle the increased bandwidth.

Bandwidth spend, particularly in companies with heavy customer engagement and/or widespread geographic locations, should be a top concern for the CIO. If the company has a large-scale legacy WAN setup (multiple hardware and software vendors, multiple carriers, and all the related infrastructure and support requirements), it will realize significant cost savings by switching to a global cloud service. Returning to our value spreadsheet, there are two things that jump out. First, we see the expected cost savings with email and Office. Second, we see a pleasant surprise with the perceived business value of email—it as increased!

When polled, employees rated the business value of email higher, because of an improvement in availability. While the old email system was meeting reliability measures, it was down just enough to impact its perceived value.

Oh, and take a look at your Bliss Factor!

Conclusion

Once value has been analyzed and contributing parts identified, other models can be used in conjunction with the value chain to assess opportunities to create competitive advantage and reduce costs. CIOs need to decide how they will adopt the cloud and transform their IT organization. This means driving change for their internal customers and increasing business agility.

Our next blog post will discuss how to transform your IT organization into a cloud service provider while accelerating business change and time to market.

Resources:

Porter, Michael E., Competitive Advantage: Creating and Sustaining Superior Performance